|

7.7.3 Bank Reconciliation

|   |

The Bank Reconciliation program allows you to balance your system “bank” with your bank statement. This program has an “auto-save” feature that saves transactions when you enter them. The term “bank” refers to the system bank (i.e. banks listed in the computer). The term “statement” refers to the bank statement you receive from your bank.

The Bank Reconciliation program requires an initial setup. These setups must be done before you start reconciling your bank with your statement.

Bank Reconciliation Setup

Before beginning to use the Bank Reconciliation program you must first setup the following programs: "Chart of Accounts Entry" in General Ledger (8.4.1), "General Ledger Setup (10.2.3)and "Accounts Receivable Setup" (10.2.2.1) both found in SYSTEM MANAGEMENT, and "Bank Entry" in ACCOUNTS PAYABLE (7.7.1). Usually this is a one-time setup. Below is a brief description of each section. Please refer to those sections of the manual for more detailed instructions.

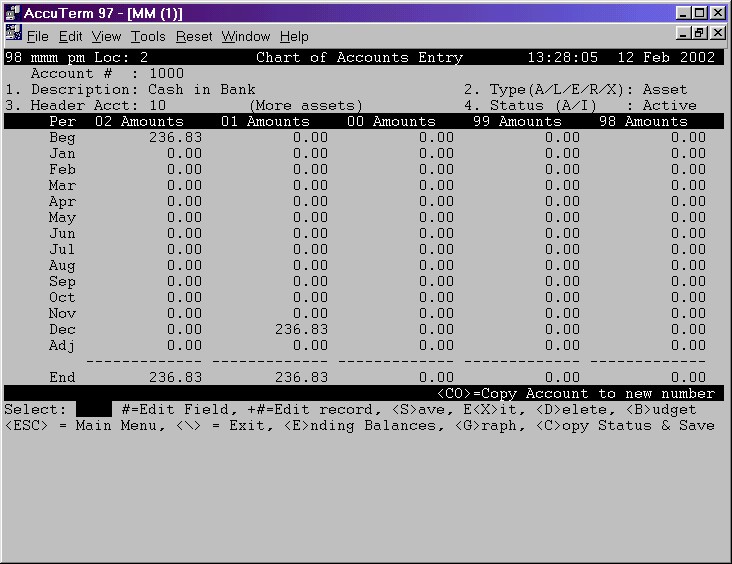

Chart of Accounts (8.4.1)

The Chart of Accounts must be created for each location. Even if you do not use the Financial Reports or other General Ledger features of Perfection Management, the Cash in Bank account number must be created in order for the Bank Reconciliation program to run.

The dollar amounts for each “cash in bank” account must be accurate. If incorrect, you may fix the amount in "Journal Entries" in GENERAL LEDGER (8.1.1).

You may view your "Chart of Accounts Listing" in GENERAL LEDGER (8.4.4.1).

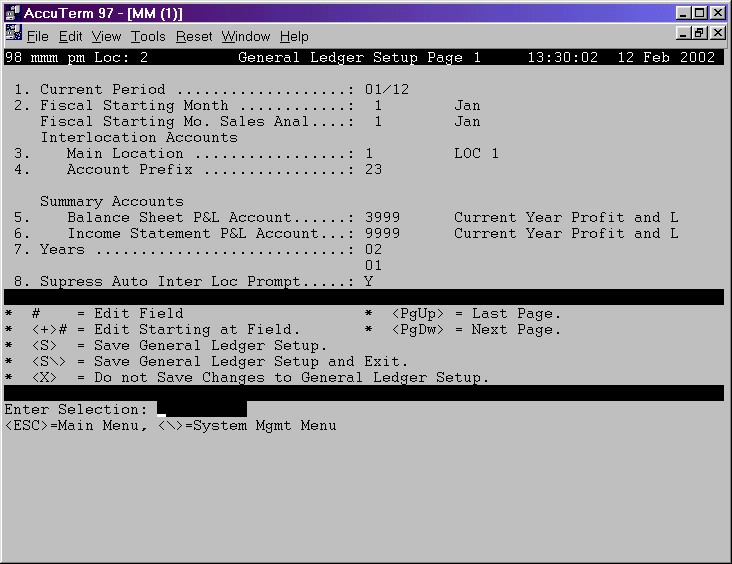

General Ledger (10.2.3)

The next step is to setup the General Ledger. Be sure that the current period is correct.

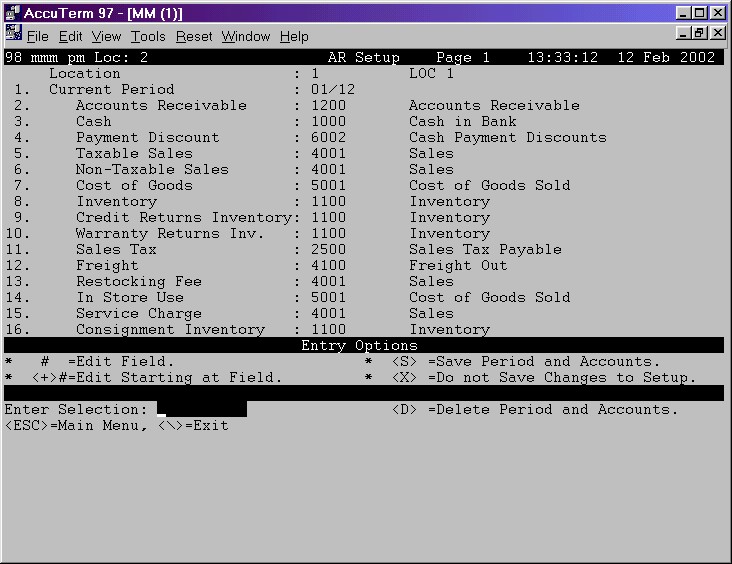

Accounts Receivable (10.2.2.1)

The Accounts Receivable Setup must be done for each location.

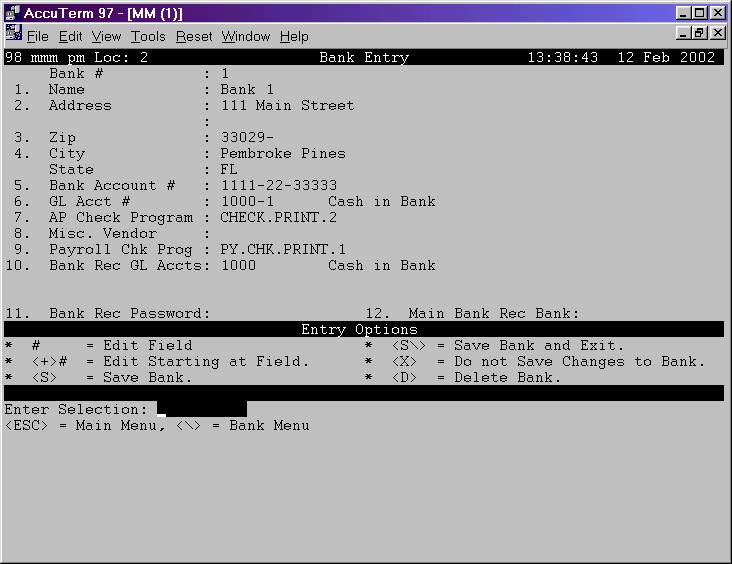

Bank Entry (7.7.1)

The Bank Entry must be setup for each Bank Account. Certain items are required before beginning the Bank Reconciliation program.

Field 6: General Ledger Account Number – Enter in the Cash in Bank account number for this bank. The location is required, example 1010-1 for location 1.

Field 10: Bank Reconciliation General Ledger Accounts – Enter the General Ledger Accounts to be included when doing a Bank Reconciliation for this bank. This field is used if you want to track another location at this Bank. If only one location, enter the General Ledger Account number without the location. That way if locations are added in the future, this field will already be setup. NOTE: Only put all of your locations under one bank. The system only looks at the first bank that the account is listed in. For example if account 1010 is listed in Bank 1 and Bank 2, the system will only capture the account in Bank 1.

Field 11: Password – You may password protect the Bank Reconciliation program. The password will not be shown on the screen. To change or delete the password, you must type in the original password for verification.

Field 12: Main Bank Reconciliation Bank - Enter a Bank to post all bank reconciliations for this Bank. This field is used when you have more than one Bank Account tracked at the same Bank.

Rebuilding Bank Reconciliation (TCL)

This next step is done only one time, just prior to doing your first Bank Reconciliation. This process will automatically unreconcile any checks selected, based on the date entered.

At the Main Menu, enter TCL and press <ENTER>.

At the colon (:), type REBUILD.BANK.REC and press <ENTER>. (Don’t forget the periods between the words.)

Enter the Date to select back to for Rebuilding the Bank Reconciliation file and press <ENTER>. This will automatically select the deposits and checks back to and including the dates entered. It is recommended to go back three months and use the first of the month.

The next prompt asks – “Do you want to select All checks that are unreconciled?” Answer <Y>es only if you are currently using the Bank Reconciliation in the system. If a Yes is entered, the process will go back 5 years. If you are not currently using the Bank Reconciliation program, just press <ENTER>.

WARNING! Do NOT post Journal Entries during this procedure.

Enter <R> and press <ENTER> to clear out the Bank Reconciliation file and Rebuild. This process may take a few minutes.

When the process is finished, you will be at a colon (:). At the colon enter an <M> and press <ENTER>. You will now be at the Main Menu.

The Setup process is now completed and you are ready to start Reconciling your Bank to your Statement.

Only items that are posted will be displayed in the Bank Reconciliation program. Be sure to post all checks and Journal Entries.

There are a few things that you need to have before starting to do a Bank Reconciliation. The first is the Statement you received from your bank. Be sure to check the statement for any bank fees. If there are any, do a Journal Entry to enter it in the system. Don’t forget to post the entry.

The next are copies of your Journal Entry Proof Reports showing deposits. The system shows individual posted items rather than the total of a deposit slip.

Now that you have these two items you are ready to begin. Start the Bank Reconciliation Program and then enter the Bank number you are reconciling.

The first prompt you will see is for the “Statement Ending Balance”. The amount of the last Ending Balance will be displayed; this is your new Statement’s Beginning Balance. Type over the amount with the new Ending Balance. You must enter in the decimal point after the dollar amount to enter the cents.

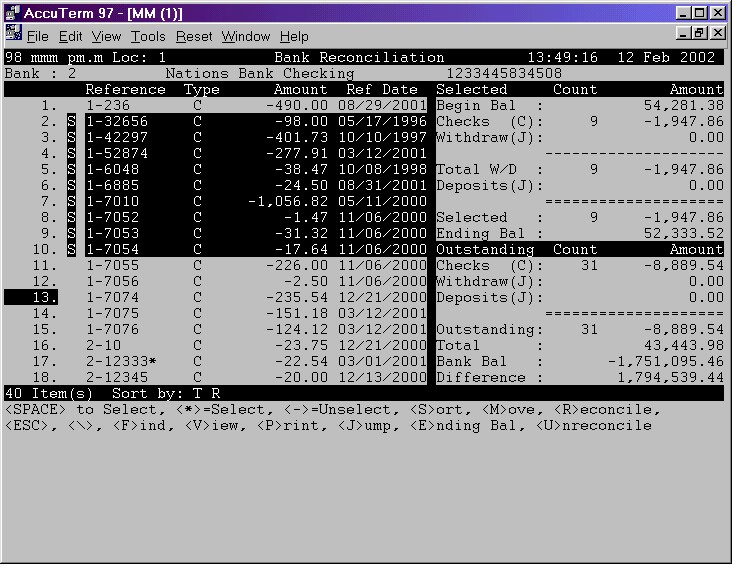

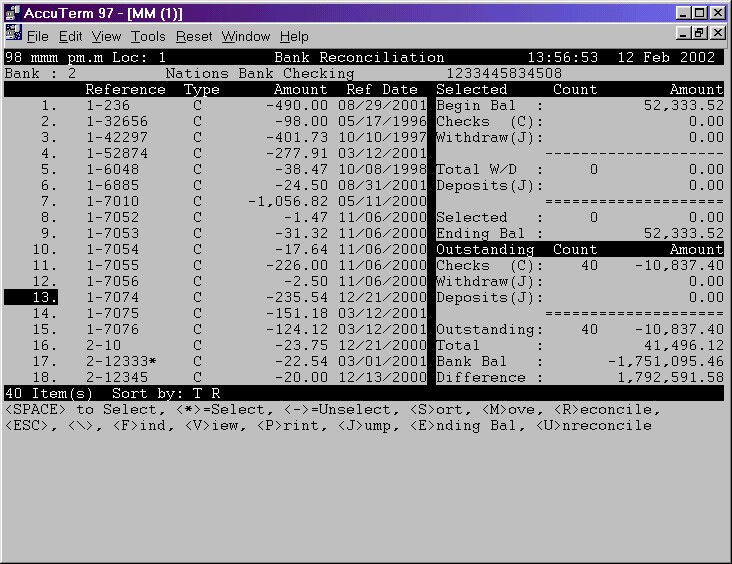

Now let’s look at the Bank Reconciliation screen. As you can see it is broken down into three sections: Reference, Selected Amounts, and Outstanding Amounts. As you select or “reconcile” items in the Reference Section, the Selected Amounts and the Outstanding Amounts sections will be updated.

Reference Section

The Reference section (located in the left window of the screen) consists of all the transactions – checks, deposits, and journal entries that have been posted but not previously reconciled. Listed below the Reference section are instructions on how to Select, Unselect, Sort, Move, Reconcile, Escape, Find, View, Print, Jump, Enter Ending Balance, and Unreconcile.

The first number listed is the item number. The Reference Number is the Journal Entry or Bank-Check number.

There are two types of items on your Statements – Checks/Debits and Deposits/Credits. This is also true for the Bank Reconciliation program. The “J” refers to a Journal Entry. The Journal Entry may have been created as an Invoice in POS Order Entry in POINT OF SALE (1.1), Payment Entry in ACCOUNTS RECEIVABLE (6.4.1), Adjustment Entry in ACCOUNTS RECEIVABLE (6.5.1) or manual Journal Entries in GENERAL LEDGER (8.1.1). Remember, all items must be posted before it is included. In the case of an Invoice, you must first post your Invoices, and then post your Journal Entries.

Items that are Debited or deducted from your bank account are listed as negative amounts – example: checks and bank fees. Items that are Credited or added to your bank account are listed as positive amounts – example: payments.

Now you are ready to Select items from your “Bank” to be Reconciled. Using your Statement, Select the items on the screen that appear on your bank statement.

To Select an individual item – Place the cursor at the number of the item to be Selected and press the SPACE BAR. An “S” is entered in front of the Reference Number and the line is highlighted.

To Select a Range of items – Enter the asterisk (*). You will be prompted with the following: “Enter Range to Select (ex. 1-99)”. Enter the beginning item number in the range, followed by a dash (-) then the ending item number in the range. Example: 2-6 will select items 2 through 6.

To Un-Select an individual item – Place the cursor on that item and press the SPACE BAR.

To Un-Select a range of items – Enter the dash (-). You will be prompted with the following: “Enter Range to Un-Select (ex. 1-99)”. Enter the beginning item number in the range, followed by a dash (-) then the ending item number in the range. Example: 3-5 will un-select items 3 through 5.

Sort the items by Selected, Reference, Type, Amount or Reference Date – Enter an <S> to Sort. Next, enter the letter of how you want the items Sorted. You may select more than one way to Sort – If you want to sort by Transaction Type then Reference Date; enter a T followed by a space, then a D (T D).

S = Sort by Selected Items

R = Sort by Reference Number

T = Sort by Transaction Type (J or C)

A = Sort by Amount – Highest negative amount to highest positive amount D = Sort by Reference Date

Move an item to another Bank - Enter an <M> to move. You will see the prompt: “Move Current Item or Selected Item”. Enter a <C> to move the item that the cursor is at, or enter an <S> to move “Selected” items. The items will be removed from the current Bank to the selected Bank.

Find an Item by Reference Type or Amount - Enter an <F> to Find. You will see the prompt: “Enter String to find Reference, Type and Amount (do not use decimals)”. A “String” is a character (number or letter). The system will search all three columns – Reference, Type and Amount. Example – to Find a check for $10.00 – enter C 1000. The Find feature will look at the first item that the cursor is on and search down. Be sure your cursor is on the first item to search all items.

View the Journal Entry or Check Entry for the information on the item - Place the cursor on the item you want to view. Enter a <V>. The screen will now display the Journal Entry or Check View. To return to the Reconcile screen, press <ESC>.

Print the items selected or all items - Enter a <P> to Print. Then enter an <S> for only items Selected or an <A> for All items.

Jumping to an item - Enter a <J>. Now enter the item number you want to go to. The cursor will now be at that item.

Re-enter the Ending Balance of the Statement at any time - Just press <E> and then the new amount. Remember, you must enter the decimal period for the amount.

Once you have Selected all the items and have checked the amounts in the Selected and Outstanding Amounts Sections (explained below), you are ready to Reconcile the Selected items. Enter an <R> to Reconcile.

If your cursor is on a selected item, you will be prompted with the following two choices:

Current Item - You may Reconcile the Current item that the cursor is on by entering a <C>. Next, enter a <Y> and press <ENTER> to Reconcile this item.

All Selected items – Reconcile all Selected items by entering an <S>. Next, enter a <Y> and press <ENTER> to Reconcile.

If your cursor is not on a selected item, you will simply be prompted to enter <Y> to Reconcile this item.

The items will be removed from the screen but not from the system.

You may also Un-Reconcile any item. This puts the items back on the screen. To Unreconcile – enter a <U>. You have a choice on which item(s) to Unreconcile.

Individual Check – enter a <C>. Enter the whole check number, which includes the bank number plus the check number (example – 1-565 is check number 565 from bank 1), then press <ENTER>. The date the check was reconciled will be displayed. Enter a <Y> to Unreconcile.

Journal Entry – enter a <J>. Enter the Journal Entry number that was listed in the Reference section. The date the Journal Entry was reconciled will be displayed. Enter a <Y> to Unreconcile.

Reconciled Date – enter a <D>. This is the date the item(s) were Reconciled on, not the Reference Date. Enter the Reconciled Date and press <ENTER>. The number of items Reconciled will be displayed. Enter a <Y> to Unreconcile.

Selected & Outstanding Amounts Sections

The Selected and Outstanding Amounts Sections are affected by the Reference Section. As items are Selected, the amounts are added or subtracted from the Amounts Sections.

Selected Amounts: When the “Ending Balance” is entered, the amount is displayed in the Selected Amount Section at the Ending Balance and the Beginning Balance. As items are Selected, the Beginning Balance changes to reflect the amounts entered. When finished, the Beginning Balance should match your Bank Statement.

Begin Balance: Statement Beginning Balance which starts at $0.00 and changes as items are Selected

Checks (C): Amounts of Checks Selected

Withdraw (J): Amounts of negative Journal Entries

Total W/D: Checks + Withdrawals

Deposits (J): Amounts of positive Journal Entries

Selected: Totals of the Selected Amounts (Deposits (J) - Total W/D)

Ending Bal: Statement Ending Balance

Outstanding Amounts: This section shows the totals of the unselected checks and journal entries listed in the Reference Section. The Outstanding Amounts will decrease as items are selected.

Checks (C): Amounts of Checks Outstanding

Withdraw (J): Amounts of negative Journal Entries Outstanding

Deposits (J): Amounts of positive Journal Entries Outstanding

Outstanding: Total of Checks, Withdrawals and Deposits not selected or reconciled

Total: Total of the Ending Balance (from the Selected Section) + Outstanding Amount

Bank Bal-GL: Total of the General Ledger Account Balance(s) for this Bank (There may be multiple Accounts setup in Bank Entry (7.7.1 field 10 - Bank Rec GL Accts)

Difference: is the sum of Total - Bank Balance from General Ledger Account(s)